For US citizens living overseas, taxes are complicated. I’m sure no one is surprised to hear that the US tax system is complex compared to most nations.

Many people do not realize that as a US person for tax purposes, they must file a United States tax return every year, even if they did not make any money from US sources. This requirement can be triggered by income as low as USD 400, depending on the taxpayer’s filing status. There is a lot more detail available on these thresholds in the US Expat Tax Guide for 2018.

Most international companies that ask people to take overseas assignments also give them the information they need to meet their United States tax obligations. But, there are others who could easily be surprised to learn they owe taxes or missed a filing deadline.

There is fortunately a company that can help. Taxes for Expats offers tax filing services that will take the burden of understanding tax laws off your shoulders so that you can relax knowing you’ve complied with the law and will not be subject to fines for failing to file or making an error.

Taxes for Expats has been preparing tax returns for more than twenty-five years. They know how to make filing taxes as painless as it can be.

Real Experts

When you choose to engage with TFX, you will be working directly with highly experienced professionals. Every tax preparer at TFX has over 10 years of relevant experience – and many have over twenty years. And, every single one of them is a United States citizen who understands US tax law. Taxes for Expats will never outsource any tax preparation work.

During this process you have access to these experts 18 hours each day. An expert is available by phone or with an online chat session. Even living abroad you can access them when it is convenient for you.

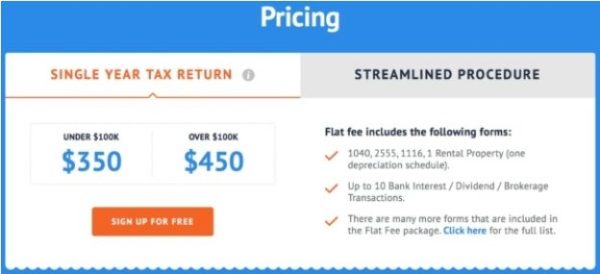

Clear Pricing Structure

There are many reasons to work with Taxes for Expats, but one that is appreciated by all of their clients is the clear, straight-forward pricing structure. Because the experts at Taxes for Expats have so much experience, they know what it takes to file US tax returns. They can translate this knowledge into simple pricing – you’ll never see a complex, hard-to-understand pricing chart from them!

A single-year return is as low as $350, flat fee. The price is actually comparable to a domestic tax return!

Working with TFX

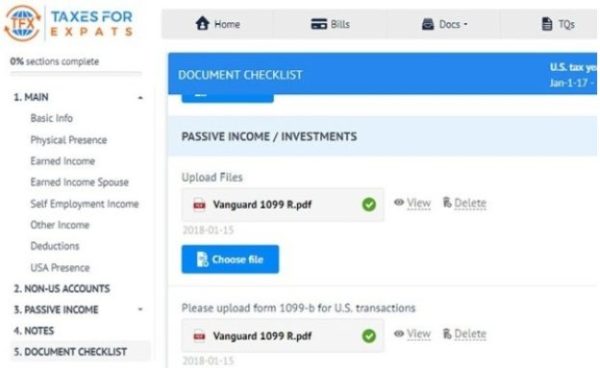

Taxes for Expats has made it a priority to create a simple system for their clients. They have put a great deal of effort into developing an easy-to-use, secure portal. Instead of uploading documents, you simply respond to questions on the web portal. This questionnaire will collect everything they need from you to complete your taxes accurately. It will even copy the information forward to future year tax returns.

It should go without saying in the modern world, but just to be sure – know that TFX encrypts everything using AES-256 encryption technology, which is industry standard.

How to Begin

Starting work with Taxes for Expats is easy.

Simply register, then schedule your 30-minute introductory phone call. This call is free but requires a $50 retainer towards the tax return fees. The experts at TFX will answer any questions you have.

Next, go online and complete the questionnaire. After answering these questions, you’ll receive an engagement letter. The engagement letter will detail the service TFX agrees to provide you, and the fees for the work. Sign the letter electronically, then sit back while the TFX experts complete your return.

The preparation process usually takes about fifteen days. Once your return is complete, simply review it, make your payment, and instruct TFX to electronically file it.

The process is just as easy, and often easier, than interacting with a local CPA for domestic taxes.

A Tax Partner You Can Trust

You know how important it is to get your taxes right. You want to know you are compliant with the law, but you also want to minimize the taxes you owe. Choosing an expert to help you is a decision you don’t take lightly. Unfortunately, the realities of living abroad make finding a local partner virtually impossible. And even face-to-face interviews are difficult. You must rely on the testimonials of current clients.

Watch the many video testimonials from TFX clients. These clients are clearly satisfied, or they would not have taken the time to record their testimonial. Anyone can write a review, but these folks put a lot of effort into expressing their satisfaction with TFX.

Another piece of evidence to look for in choosing a tax partner is the number of clients who trust them. Taxes for Expats files returns for over 20,000 people at 1,000 different organizations all around the world, including big names like Google, Microsoft, and IBM. These clients live in over 190 countries.

- List of the International Airports in Romania (with Map) - April 25, 2024

- Beach, Please Festival 2024: Lineup, Schedule & Dates [Updated April 24] - April 24, 2024

- Best Music Festivals in Romania – with Dates & Lineups [2024 Update] - April 17, 2024

Calin, I hope they are paying you well for this advertisement. It’s good to know how much I am saving myself by doing my taxes by myself.

I’ve been doing the papers by myself for a couple of years, with minor help from a retired accountant and everything appeared to be good. But starting this year I decided to seek professional advice and I was surprised to find out that there was a lot more to be done – business wise – than what I was doing.

It is true that in Romania, legislation changes constantly and things are probably calmer over seas, but I am still sure that for many people, actually getting some help when it comes to filling the papers and doing it right, the benefits outweigh the costs.

Doing taxes suck for sure! That old saying about death and taxes is true 🙂 . Even though we don’t make any money either place, it costs a lot to have the accountant file zero for us, but you know what? I’d rather leave it in the hands of someone who knows what they’re doing.

I really agree! As I was saying in the above comment – I was 100% sure that I was doing it right until I got an accountant who told me that although what I was doing was indeed correct, there was a lot more that had to be done. Best part? She’s doing everything now and I don’t have to 🙂

Oh Calin,

What can I say…?

I was hoping to hear about España;-)

If I make it to 65, I hope you will have partnered with an “Expats” company which will handle not only taxes, but accommodations, transportation, and most importantly visas for Yanks who want to retire to lovely Romania. (Hopefully that madman Trump won’t have poisoned the Romanians’ minds against all Yanks!)

Ciao,

~Teil

Hello Teil,

We’ve also been to Bulgaria since returning to Spain – it has been an extremely busy time here so I don’t even know if I will be able to write about our stay in Spain…

But I can say that although Valencia is extremely beautiful and we completely enjoyed our time there, it wasn’t really the type of city that really suits my family’s way of living. They are great for outgoing, extroverts who enjoy spending time outside, eating tapas and tasting the huge variety of drinks. But their work schedule and especially sleeping schedule is the complete opposite to ours and we often found us during our stay there walking on empty streets with closed shops 🙂

It’s not their fault and those who can make the adjustment will be rewarded with great, warm people and amazing places to see, but if you are a morning person like myself, things won’t be that good :)) Price-wise, Valencia is a mixture of “way more expensive than Romania” (restaurants especially, but most of the supermarket foods as well) to “how is it possible to be cheaper than Romania?” (you can have some great accommodation deals if you can spend some time searching, some of the food is way cheaper than in Romania and so on). Overall, I believe that with careful planning, somebody would still be able to live on about the same or a slightly higher budget in Spain as in Romania. And you get people who are more relaxed and the weather is supposed to be warmer year-long than in Romania (in our case though, during our stay, it was hotter in Romania than in Valencia).

Calin,

You are such a “nomad”! Nosy me–where did you go/stay in Bulgaria?

Thanks for “trip report” on Valencia and Spain.

I know they enjoy their midday siestas. Probably more people should

take siestas.;-)

Are you still working on your cottage, or did you give up on that?

Take care!

~Teil (USA)

p.s. I disavow all Trump says and does!!!

We stayed there for a week – a true holiday at an all inclusive hotel in Golden Sands. It was all relaxing, eating and soaking up the sun for us 🙂 Last year we were in Albena, also in Bulgaria, and I liked Albena better than Golden Sands and the hotel as well. You can’t always get them right, no matter how much research you do 🙂

I am with you Teil. I look forward to escaping this backwards country when we move to Romania. I have no idea where the United States is headed but it is not looking good at all. About those taxes… I spoke with my HR Block tax preparer and she gold me all i had to do is get her a copy of my year end income statement and she would take care of my filing for about $200 bucks. My wife who is Romanian will work and I will work on line expecting to earn about 15k a year. I do not expect our tax filing to be a big deal but was plenty worried about it before speaking with our current tax preparer. I was told we would not have to file if earning under 20k but we will because we will get a refund.

C. –> We need to see your latest cost of living article. I know things have changed and probably not looking as good as it has in the past. But we need the bottom line truth. Is your family of 3 still living well on $1500 a month? I am counting on it.

Hello Otto! The cost of living article will have to unfortunately wait until early next year when I will have this year’s data rounded up in terms of costs for us. Doing that kind of articles involves a lot of work and very, very few people (strangely) end up reading them. But since the last one based on our expenses was written in 2015 and the latest generic cost of living article was written a while ago, I will surely have it ready at the end of the year.

Regarding the costs, our spending has indeed increased quite a bit, but I wouldn’t put it all on the inflation and the increase in prices over here. We were just very careless with our spending, we had some delayed expenses this year (a massive wardrobe refresh, some car repairs) and we ate out a lot more than we used to. I hope that now that things have settled down a bit we’ll manage to make up a bit of the extra money spent.

But with that in mind, we are still just over $1,500 per month in terms of spending, so I still believe that it’s doable to live on $1,500 per month as a family of three if you have your accommodation paid for. Even without it, it could be doable.

Otto:

Good luck with your escape!

You definitely have good luck with marrying a Romanian lady.

(They all seem so lovely.)

Teil (Still stuck in the muck and mire of the USA!)

—>Calin: Maybe next year, try one of Portugal’s beaches?

Hi, off topic question.. do all employees are required to pay social insurance in romania? No exemption for expats?

Yes, you have to pay social security no matter what. If employed, this is usually done by the employer, though.

Hello again,

Thanks for your response.. additional question for social contribution. Can we reimburse the payment for our social contribution after termination of our contract? We only have 2 years contract.